You are likely funding climate pollution, military weapons, and forced labor, here's how to divest.

Good lives do not have to cost the Earth

Over half of working-age individuals (the ones with 401Ks) are funding military weapons manufacturers, fossil fuel expansion, firearms, deforestation, child labor, harmful pesticides and for-profit prisons. Almost all of the people supporting these companies—very likely including you dear reader—do this unknowingly. And don’t worry, the other half of working-age individuals (no 401Ks) very likely fund those things indirectly through the companies they bank with. We’re in this together! (derogatory).

The reigning economic philosophy of the past several decades has been focused on a single metric optimization: profit. And I must specify financial profit, because there are other ways to profit, and there are many important metrics to living a healthy and fulfilling life not included in financial profit. This singular focus on profit at the company level and GDP at the national level was put into hyperdrive by Reaganomics in the 1980s when the great “trickle down” gamble began. Since then, our entire economy has been experimenting with what happens when you ignore social cohesion through shared prosperity (post-war through 1980) and fuck around and find out how massive inequality might work instead (1980 to now). GDP famously doesn’t measure income inequality or social stability or life expectancy or the quality of our education, and as such, has been regarded as an inane idea since much before Reaganomics.

On a basketball court at the University of Kansas Robert F. Kennedy gave a speech decrying the near-sightedness of GDP. It was 1968 and he could already see the problem of using a metric that lumps social ‘bads’ so long as they can be measured in dollars and excludes many social ‘goods’ that can’t be. In his speech to an enraptured college audience he said:

“[The GDP] counts air pollution and cigarette advertising and ambulances to clear our highways of carnage… it counts special locks for our doors and the jails for the people who break them. It counts the destruction of the redwood and the loss of our natural wonder in chaotic sprawl. It counts napalm and counts nuclear warheads and armored cars for the police to fight the riots in our cities. It counts Whitman’s rifle and Speck’s knife…. but it fails to measure the health of our children, the quality of their education or the joy of their play.”

This is a long-winded way of pointing out that… we are still counting those things, prioritizing them, investing in them, blindly, because they have the highest financial returns and have therefore populated and blighted nearly everyone’s investment portfolios. In my next newsletter we will explore the concept of Regenerative Economics - and what it might mean if our money circled back into activities that are judged by more than one metric, judged by holistic metrics of social and environmental health, judged by their true profit.

But today we’re staying focused on Investments and how and where to move them. Let’s take a deeper look into what companies are likely lurking in your investments.

When I used to be a good corporate boy working at a Big Pharma company, my only choice for my 401K was to invest in a Vanguard fund. If you haven’t made a very specific and active choice in selecting your 401K, the chances are you also are investing in the same or very similar index. Before I made the change, here is what used to be in my Vangaurd Target Retirement 2060 Fund (VTTSX):

Fossil Fuel Companies

175 holdings in the top 200 owners of carbon reserves. AKA people who own the carbon reserves in the ground we desperately need to keep it in the ground (often called carbon bombs). With your investments they are incentivized to turn that reserve carbon into money (and greenhouse gasses).

230 holdings in the coal industry

510 holdings in the oil & gas industry

376 holdings in fossil fuel utilities

Highlights include:

Weapons Manufacturers & Military Contractors

207 holdings in military contractors including: Raytheon, Boeing, Lockheed Martin, Honeywell, Northrop Grumman, General Dynamics and pretty much every other big bad you can think of.

76 holdings in nuclear weapons manufacturers and servicers.

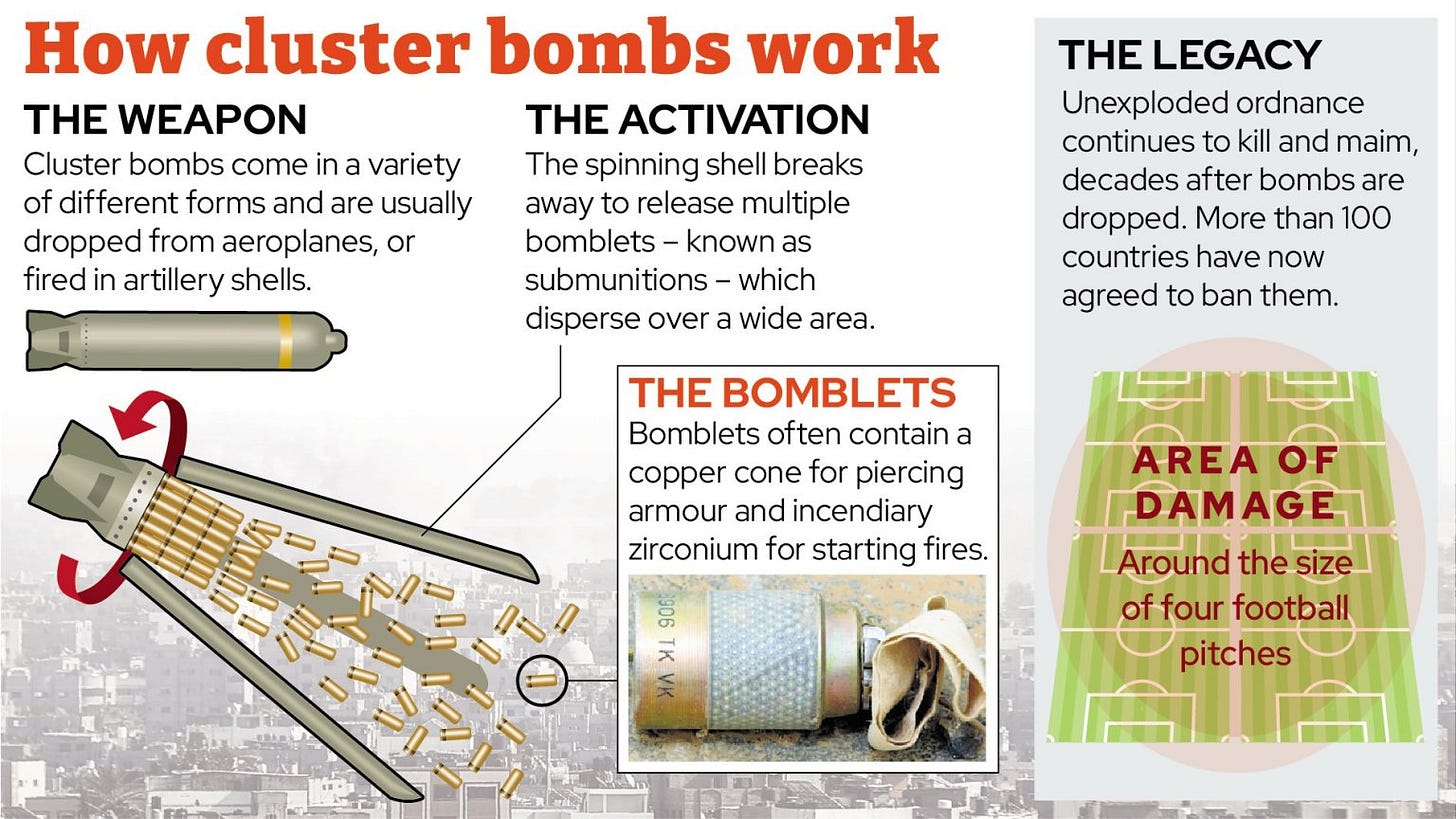

29 holdings in controversial weapons manufacturers such as cluster munitions, landmines, white phosphorus, and depleted uranium.

Deforestation Companies

Retailers that source palm oil, paper, rubber, timber, cattle, and soy from deforestation-risk areas.

Amazon.com, Johnson & Johnson, The Home Depot, Procter & Gamble, Costco, Nestle, Walmart, and PepsiCo.

A bunch of companies you’ve probably never heard of that produce and trade those deforestation causing commodities.

Many financial institutions you have heard of that finance those deforestation projects: JPMorgan Chase, Bank of America, HSBC, Mitsubishi, Morgan Stanley, Citigroup, etc.

Guns, Drugs and Prison Companies

I also was blissfully unaware, in those years I held a Vanguard index, that I supported 19 firearm retailers and manufacturers: Walmart, Dick’s Sporting Goods, Big 5, Colt, Sturm Ruger, Olin Corp, Smith & Wesson Brands, etc.

I supported 29 holdings in tobacco producers and promoters: Philip Morris, British American Tobacco, Japan Tobacco, Imperial Brands, Comcast, AT&T, Paramount Global, and on and on.

And many private prison operators: CoreCivic, Sodexo, Serco, Mitie, and those that help them operate: Palantir, Microsoft, Amazon, Alphabet Inc (Google), Salesforce, Thermo Fisher, McDonald’s Corp, and on.

Perhaps unsurprisingly, many of the big bad weapons manufacturers are involved with for-profit prisons: Raytheon, Lockheed Martin, Airbus, General Dynamics, Northrop Grumman, Motorola. All the more reasons to dump them.

What is the Alternative?

If you’re thinking, “jeez, are there any companies left?” Let’s take a minute and reflect on what that means if every large company we have heard of is implicated in a society or ecology destroying activity…

[…]

[Keep considering…]

[…]

Okay now that we’ve considered the fundamentals underlying our economy and its incentives are broken, let’s talk about what we can do about it.

Here are several resources you can use to make more ethical investment decisions:

1. Investigate your retirement plan:

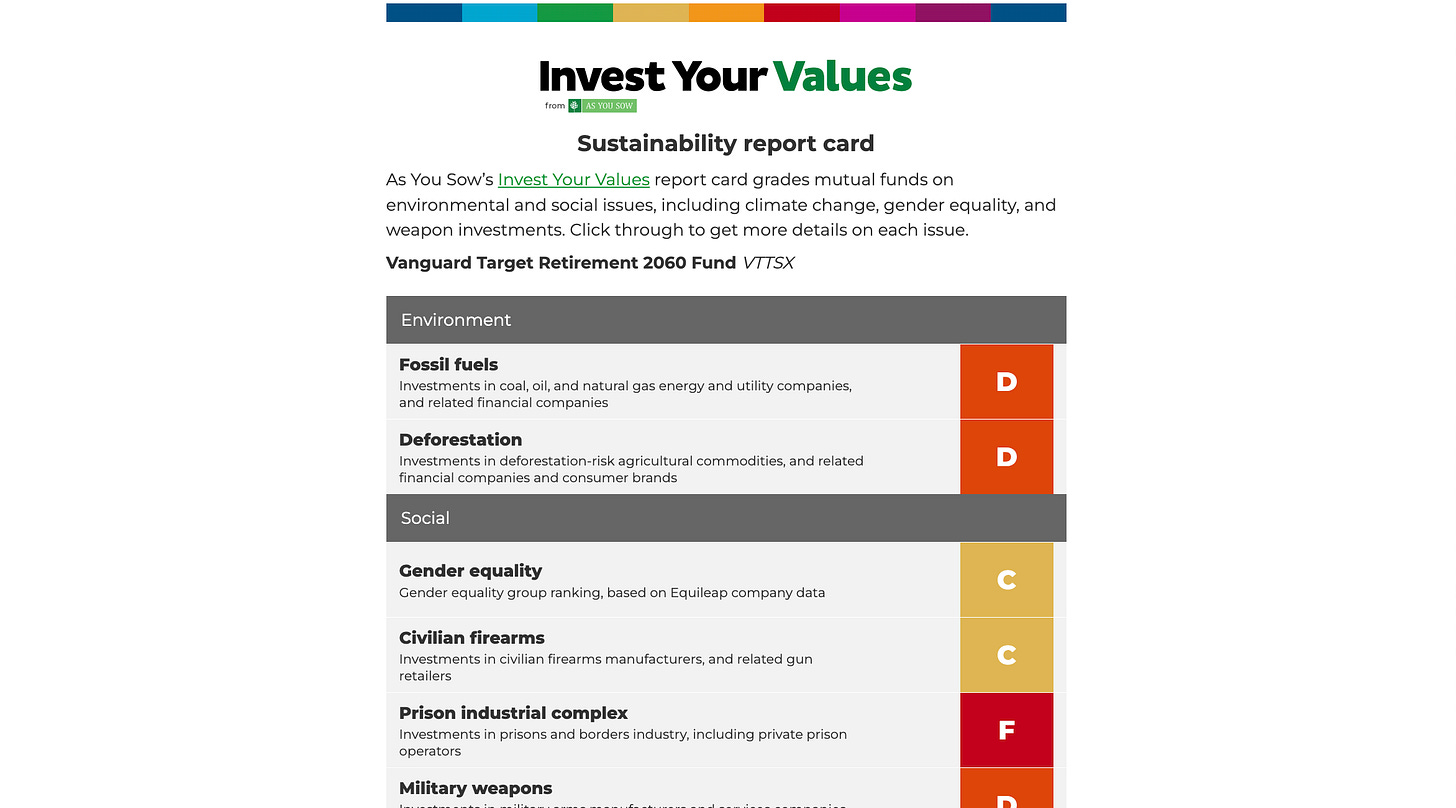

Check out As You Sow, where you can get a full report card detailing your holdings across fossil fuels, deforestation, weapons manufacturing, firearms, gender equity, prison-labor, and tobacco support.

2. Move your retirement savings to a more ethical and climate beneficial index:

Carbon Collective: Invest in Solving Climate Change: my nonprofit uses Carbon Collective, so I’m happy to report my 401k is no longer funding everything bad on Earth. As You Sow gives their fund a B, so there’s room for improvement, but it’s leaps and bounds better than most. As You Sow uses Carbon Collective for their own retirement funds, so that’s a pretty good sign.

3. Move your money away from banks that fund and finance terrible things and into banks that are gonna make life better:

Know your worst offenders, AKA The Dirty Dozen via Banking on Climate Chaos:

Move to a better alternative:

Beneficial State Bank, Ethical Banking for People and Planet

Check out Aspiration, Atmos, and Amalgamated Bank (Nick and I use Aspiration)

Also, most local banks, public banks, and credit unions reinvest your money into your community instead of into fossil fuels and weapons! Support them!

4. Change who does your insurance

Premiums for the Planet: “Our movement rallies and coordinates

climate-conscious organizations, directing their insurance premiums to drive climate stewardship.”

Most insurers invest their premiums into coal and fossil fuel expansion projects among many other projects that inflict social harm. Premiums for the Planet will give you better coverage for the same price without it costing the Earth.

5. Last But Not Least, Tell your Employer about CSAs (no, not the box of veggies):

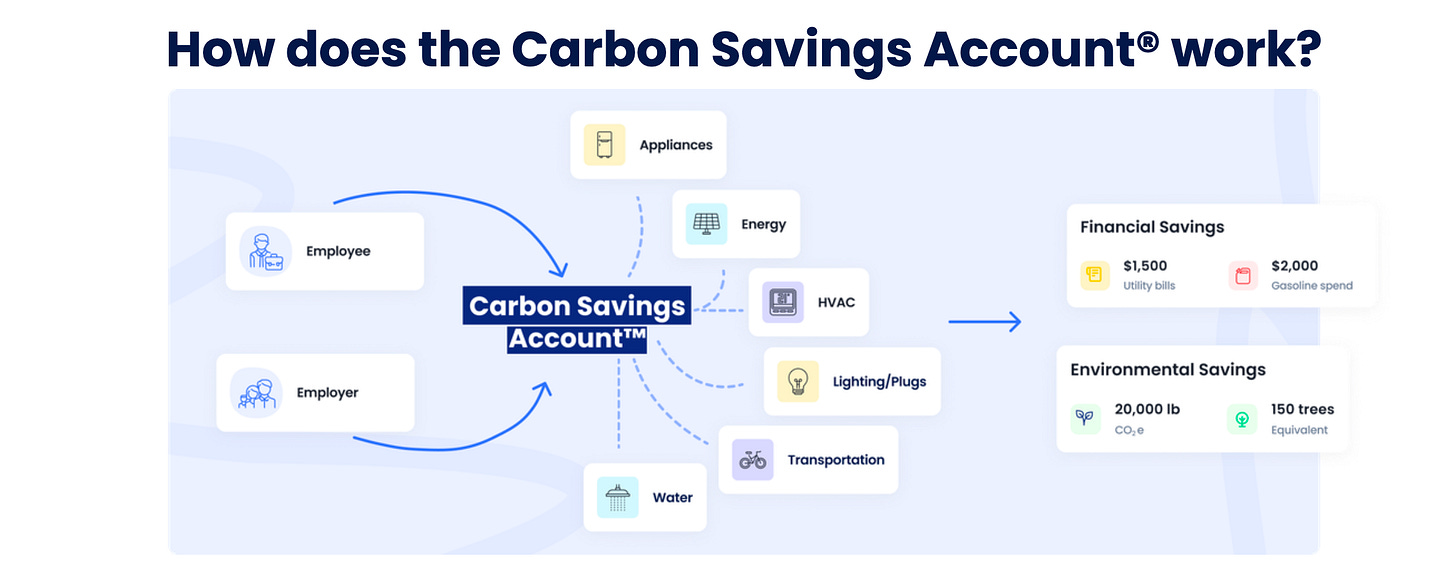

One of the coolest companies I saw at SF Climate Week last week was Scope Zero’s Carbon Savings Account. For anyone that might have an HSA (Health Savings Account) where you squirrel away pre-tax dollars matched by your employer that you can later spend on approved health expenses… this is that but for climate-approved expenses.

Although the Inflation Reduction Act is making home electrification more affordable, it is still cost-prohibitive. The truth is, pretty much everyone needs to figure out how to finance electric appliances, e-bikes, and renewable energy solutions, but that takes some savings to accomplish. Enter the Carbon Savings Account. With a little help, all of these efficiency measure will end up saving you money (and the planet) in the long run.

Bring all this information to your HR Department or relevant person at work!!!! And please let me know if you or the company you work for implements any of these changes. I want to hear about it :)

Love you all,

Spencer

Thank you for another great, comprehensive piece about all this crazy shit.... and YES for line breaks where we have to sit with this information!! Society- and ecology-destroying powers that be are so ubiquitous, we hardly consider it abnormal at this point. it's terrifying. so we have to read and (re)learn and meditate on everything around us. You clearly incorporated those values into this piece so thank you -- now I know more!!

It sucks because all these companies have the resources to make banking, shopping, etc so convenient, but it’s not difficult to make these small switches, and the more of us that make the changes the more it will affect these investments.

Thanks for pointing out the bad players and providing options for solutions.